Cyprus SME Digital Grant 2025 – 50% Co-Funding Available

Impact

The Digital Transformation Scheme for Enterprises 2025 drives the digital transformation of Cyprus SMEs under the ΘΑλΕΙΑ 2021–2027 framework, encouraging adoption of AI, blockchain, cloud-native architectures, and e-commerce to boost competitiveness and growth.

Program Objectives

- Support the digital transformation of existing and new SMEs

- Promote digital entrepreneurship

- Encourage use of modern technologies like AI, cloud, IoT, and blockchain

- Strengthen Cyprus’ overall digital economy

Total Budget & Co-funding

- Total budget: € 20 million

- 2025 call allocation: € 14 million

- Co-financing: Republic of Cyprus & the European Regional Development Fund

Who Can Apply?

SME Definition:

- Staff: < 250

- Turnover: ≤ € 50 million or Balance sheet: ≤ € 43 million

You’re eligible if you are:

- Existing SMEs: Established and active before 1 January 2024

- New SMEs: Established in/after 2024, or inactive until 31 December 2023, provided they include an e-shop or advanced digital tech in their proposal

Exclusions:

- Primary agricultural producers & fisheries

- “Problematic” enterprises under EU Reg. 651/2014

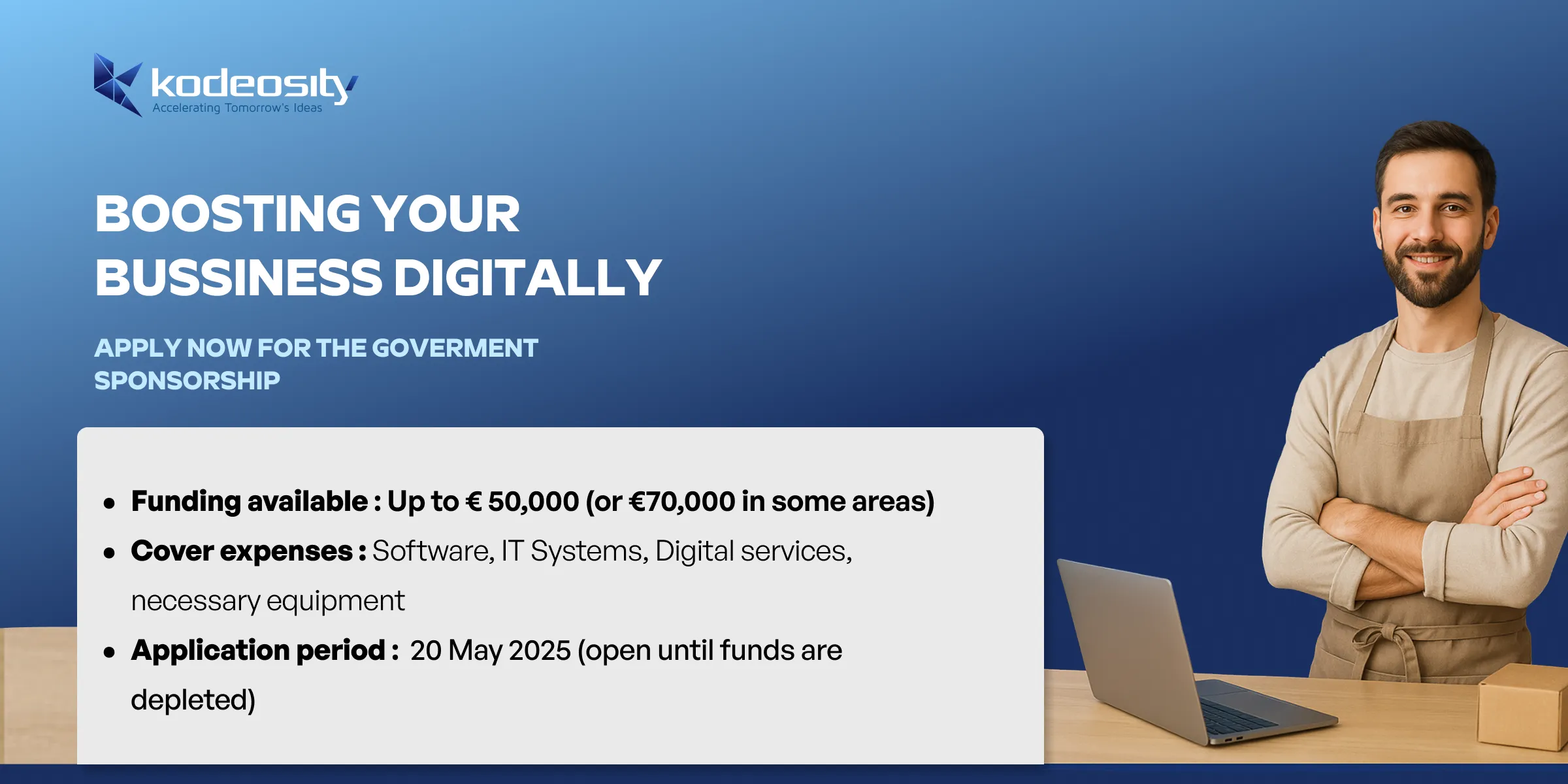

Budget, Intensity & Funding

| Location | Minimum Eligible Budget | Funding Rate | Max Grant | De minimis Cap | Own Contribution | Deadline |

|---|---|---|---|---|---|---|

| Most areas of Cyprus | €5,000 | 50% | €50,000 | €300,000 per 3 years | 50% (via equity or bank-backed loan) | 12 months from approval |

| Mountainous/disadvantaged areas | €5,000 | 70% | €70,000 | €300,000 per 3 years | 30% (via equity or bank-backed loan) | 12 months from approval |

Eligible Expenses

- Off-the-shelf software (licenses & cloud/SaaS up to 36 months)

- Specialized IT systems

- ERP, CRM, BI, bespoke development

- E-shop platforms, Automations, IoT, AI, blockchain, data analytics

- Digital marketing

- Up to 10% of e-shop budget (max €4,000)

- Online promotion & SEO services

- Consultancy

- Needs analysis & project management (max €1,000)

- Hardware

- Servers, firewalls, SAN, handheld terminals, electronic shelf labels, RFIDs (only if integral to the digital upgrade)

Not Eligible: Maintenance contracts, simple websites, refurbished equipment, GPS devices, VAT

Application Process & Timeline

- Call Publication: April 2025 on the Ministry portal

- Submission: Online via ΥΕΕΒ — one proposal per call, open until funds are depleted

- Eligibility Check: Formal docs, financials, de minimis compliance

- Evaluation & Ranking:

- Automatic ranking by submission timestamp

- Possible on-site verifications

- Scoring Criteria:

- Quality: Clarity, completeness, deliverables & timelines

- Relevance: Alignment with scheme objectives

- Viability: Financial capacity & sustainability

- Implementation Period: Up to 12 months from contract signature

- Payments: Upon submission of paid invoices & proof of payment

- Audits: Random checks up to 3 years post-completion

Required Documentation

- Audited Financial Statements for 2022–2023 (or tax returns for micro-enterprises)

- 2024 Revenue Statement or sworn turnover declaration

- Bank Statement or Loan Approval Letter for own contribution

- De minimis Declaration, signed by an auditor or executive

- Conflict of Interest Declaration for consultants (if claimed)

- Detailed Quotes for each expense (technical specs & cost breakdown)

How to Apply

Applications are submitted online via: 👉 https://fundingapps.meci.gov.cy

⏱️ Tip: Evaluation is first-come, first-served. Apply early for a better chance.

💡 Note: Although the application process does not strictly require a business consultant, around 98% of businesses choose to work with one to maximize their chances of approval. In fact, using a business consultant is encouraged by the grant itself, as it covers consultant costs up to €1,000.

How We Can Help

At Kodeosity, we can help you in:

- Crafting grant-eligible e-commerce and software solutions

- Supporting you through the entire application process via digital consultations

- We can collaborate with your business consultant in order to meet government grant criteria

FAQs

Is this a one-time grant?

No, while the current call is part of the 2021–2027 programming period and the 2025 intake is one of the last major rounds, there may be additional opportunities in the future. However, the timing and availability of future rounds depend on decisions made by the Ministry of Energy, Commerce and Industry.

Can I get help applying?

Absolutely. We create grant-eligible proposals and can refer you to a trusted business consultant—or collaborate with your own—to ensure all documents are ready for submission.

What kinds of businesses have already benefited?

E-commerce stores, law firms, logistics companies, tourism SMEs, and service-based startups have all received grants in previous rounds.

Can micro-enterprises apply?

Yes—provided they meet turnover/balance sheet criteria and include an e-shop or advanced digital tech in their proposal.

What’s the deadline?

The call is open until funds are depleted. Apply early for a better chance—usually, the portal remains open for only a few hours. For this round, applications open on May 20th, 2025.

What happens if I miss the 12-month implementation deadline?

You risk losing part or all of the grant; extensions may be granted only under exceptional circumstances with written request.

Can I apply for the grant if my company has received other EU or government funding?

Yes, but you must ensure the total aid received does not exceed the de minimis cap (€300,000 over 3 years) and that there is no double funding for the same expenses. Your business consultant can help clarify this for you.

What happens if my project scope changes after approval?

Any significant changes to the project scope, budget, or deliverables must be communicated to and approved by the grant authority. Unauthorized changes may result in loss of funding.

Are there any post-grant obligations or audits?

Yes, your company may be subject to audits for up to 3 years after project completion. You must retain all documentation and be able to demonstrate compliance with grant terms.

How quickly are funds disbursed after submitting invoices?

Payments are made after submission and verification of paid invoices and proof of payment. The processing time depends on the completeness of your documentation and the authority’s workload.

What are the most common reasons for application rejection?

Common reasons include incomplete documentation, ineligible expenses, exceeding the de minimis cap, or not meeting SME criteria.

What digital solutions are most likely to be approved?

Projects that clearly align with digital transformation goals—such as e-commerce, AI, cloud migration, and advanced analytics—are favored. Simple website upgrades are not eligible.

Is there support for preparing the technical specifications or business plan?

Yes, consultancy costs for needs analysis and project management are eligible up to a specified limit (e.g., €1,000). This can be used to cover your business consultant’s fees.

Don’t Miss Out

This is a unique opportunity to transform your business with government support. Let’s build your application together and create a digital solution that moves your business forward.